- Keskan Finance

- Topics

- Trade Finance

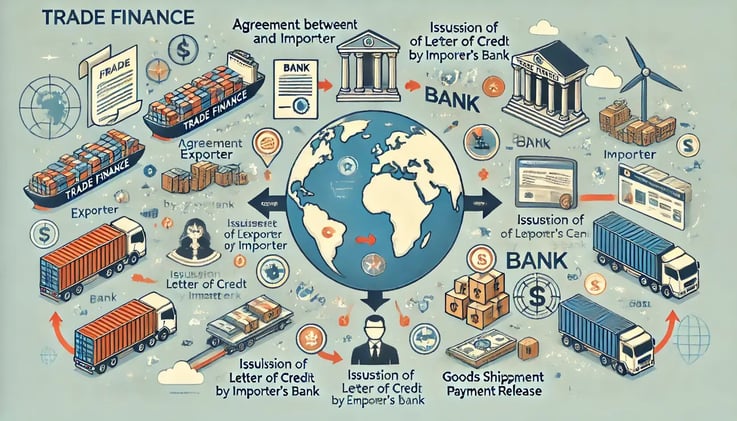

Trade Finance

Trade finance encompasses a set of financial instruments and products that facilitate international trade and commerce, helping importers and exporters manage the risks associated with cross-border transactions. Here are some key components: Letters of Credit (LCs): A commitment from the buyer's bank guaranteeing payment to the seller if terms and conditions are met. It provides security to both parties. Trade Credit Insurance: Protects exporters against the risk of buyer non-payment. It can cover a range of risks, including political and economic uncertainties. Export Financing: Offers short-term loans to exporters to fulfill overseas orders, helping bridge cash flow gaps. Bank Guarantees: A bank's promise to cover a loss if a buyer defaults, often used in contracts where delivery of goods or services occurs over time. Factoring and Invoice Financing: Allows exporters to sell invoices to a financial institution to get immediate cash, enhancing liquidity while waiting for payments. Supply Chain Finance (SCF): Often leverages technology to optimize working capital and manage risks through tools like early payment discounts, reverse factoring, and dynamic discounting. Trade finance simplifies international trade processes, ensuring efficient cross-border transactions and expanding global market access.

Export FinanceExport Finance

+2+2

Export FinanceExport Finance

+2+2